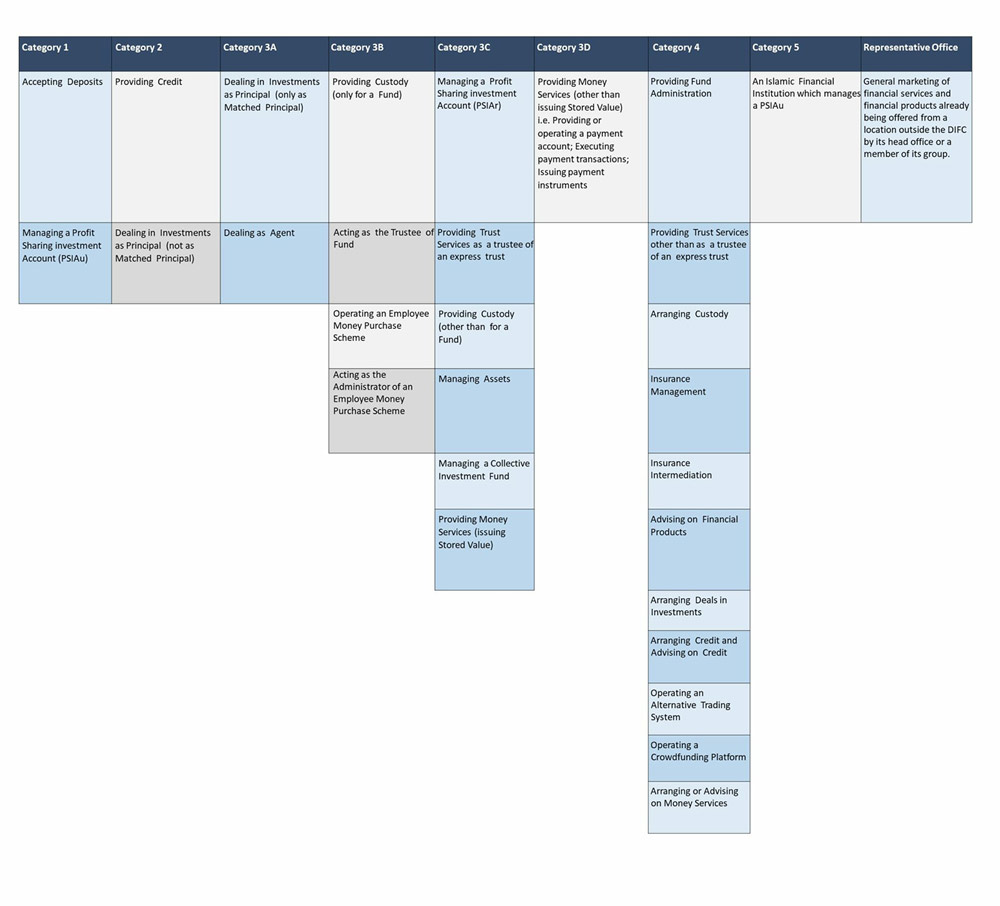

Authorised Firms in this category can do one or more of

Arranging Deals in Investments, Advising on Financial

Products, Arranging Custody, Insurance Intermediation,

Insurance Management, Operating an Alternative Trading

System, Providing Fund Administration, Arranging Credit

and Advising on Credit, operating a Crowdfunding Platform

and/or Providing Trust Services (other than as a trustee

of an express trust). In Categories 2-4, Authorised Firms

may apply to conduct their business in a wholly Sharia

Compliant manner or through an Islamic Window.

Base Capital – US$ 10,000

Expenditure-based capital requirement of 6/52 of annual

operating expenditure (18/52 if will holding or

controlling Client Money).

Note that additional capital requirements may be imposed

by FSRA on the review of the application.