There is no single global body governing the forex market to

police the massive 24/7 market.

Instead, several governmental and independent bodies supervise

forex trading around the world.

The supervisory bodies regulate forex by setting standards that

all brokers under their jurisdiction must comply with.

These standards include being registered and licensed with the

regulatory body, undergoing regular audits, communicating certain

changes of service to their clients, and more.

Licensed forex brokers are subject to recurrent audits, reviews

and evaluations to ensure that they meet the industry standards.

This helps ensure that currency trading is ethical and fair for

all involved.

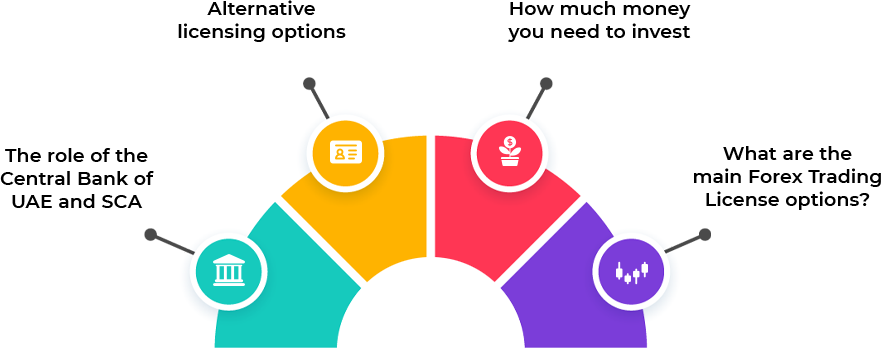

Every country has its regulatory authority that lays down the

framework of rules that are to be complied with when operating in

the forex trading market.

Each forex regulatory body operates within its own jurisdiction

and regulation and enforcement vary significantly from country to

country.